THANK YOU FOR SUBSCRIBING

Editor's Pick (1 - 4 of 8)

A 6 year Window of Opportunity for Refinery Equipment and MRO Service Providers

Subbu Bettadapura, Sr. Director-Consulting, Energy & Environment Practice, Frost & Sullivan

Subbu Bettadapura, Sr. Director-Consulting, Energy & Environment Practice, Frost & Sullivan

The Asia Pacific region is projected to add 3.3mb/d by 2023 with the Middle East region adding 1.6mb/d during the same period. Hence, these two geographies also become hotspots for the growing refinery MRO market.

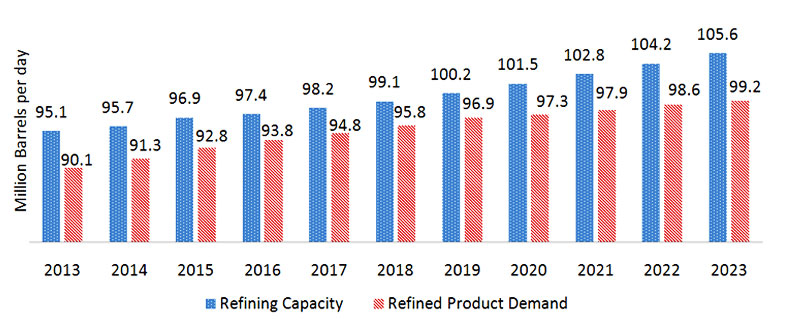

The refined product demand is forecast to grow from 94.8mb/d in 2017 to 99.2mb/d in 2023.

Refined Product Demand Analysis

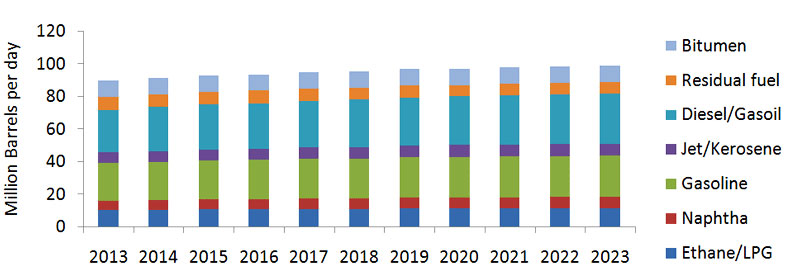

The design and complexity of a refinery would take into account the crude input and the desired products based on market demand. A good understanding of the product demand by region would be important to understand the upcoming opportunities.

The demand for middle distillates such as Diesel and Gasoline will be largest till 2023. Regulatory changes such as MARPOL are to drive diesel demand growth.

There is scope for a significant demand decline for Gasoline in the long term after 2023 due to the expected increase in market penetration of electric vehicles and increased efficiencies of the engines using this fuel. In the marine sector, diesel could face a threat from LNG bunkering. Since LNG bunkering will need significant investments to be set up the supply infrastructure, marine grade diesel oil will continue to be in high demand. Hence, diesel demand will clearly be higher than gasoline demand after 2023.

The forecast also indicates that demand growth will increase for light products such as LPG and Naptha.

The Asia Pacific region is projected to add 3.3mb/d by 2023 with the Middle East region adding 1.6mb/d during the same period. Hence, these two geographies also become hotspots for the growing refinery MRO market.

The refined product demand is forecast to grow from 94.8mb/d in 2017 to 99.2mb/d in 2023.

Refined Product Demand Analysis

The design and complexity of a refinery would take into account the crude input and the desired products based on market demand. A good understanding of the product demand by region would be important to understand the upcoming opportunities.

The demand for middle distillates such as Diesel and Gasoline will be largest till 2023. Regulatory changes such as MARPOL are to drive diesel demand growth.

There is scope for a significant demand decline for Gasoline in the long term after 2023 due to the expected increase in market penetration of electric vehicles and increased efficiencies of the engines using this fuel. In the marine sector, diesel could face a threat from LNG bunkering. Since LNG bunkering will need significant investments to be set up the supply infrastructure, marine grade diesel oil will continue to be in high demand. Hence, diesel demand will clearly be higher than gasoline demand after 2023.

The forecast also indicates that demand growth will increase for light products such as LPG and Naptha.By 2023, Asia Pacific is to account for 35.3 percent of the global refined product demand making it the largest regional market

The demand for refined product in Asia Pacific steadily increases driven by China, India and Southeast Asia.

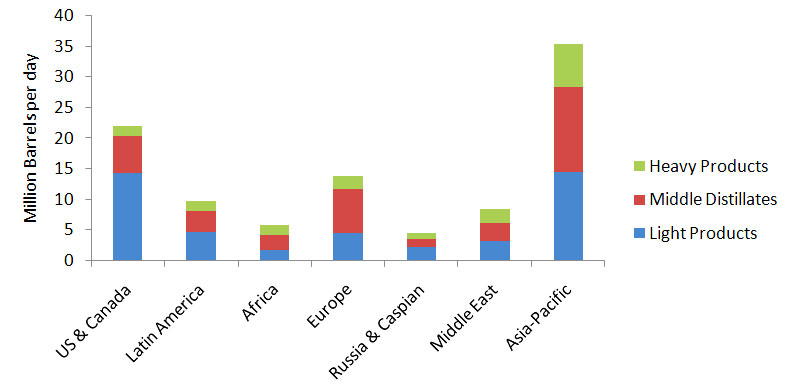

By 2023, Asia Pacific is to account for 35.3 percent of the global refined product demand making it the largest regional market. North America (USA and Canada) would account for 22 percent of the total demand.

Exhibit 3: Demand Analysis of Refined Product Forecast by Region, Global, 2023

The demand for refined product in Asia Pacific steadily increases driven by China, India and Southeast Asia.

By 2023, Asia Pacific is to account for 35.3 percent of the global refined product demand making it the largest regional market. North America (USA and Canada) would account for 22 percent of the total demand.

Exhibit 3: Demand Analysis of Refined Product Forecast by Region, Global, 2023

Even though Asia Pacific region adds significant refining capacity, the region is anticipated to have shortages of middle distillates by 2023. This demand can be met by North America, Middle East and Europe supplies. These regions would have a surplus of middle distillates to cater to the increase Asia demand. North America projects would be geared towards processing of extra light crude from shale oil.

Quantifying the Opportunities

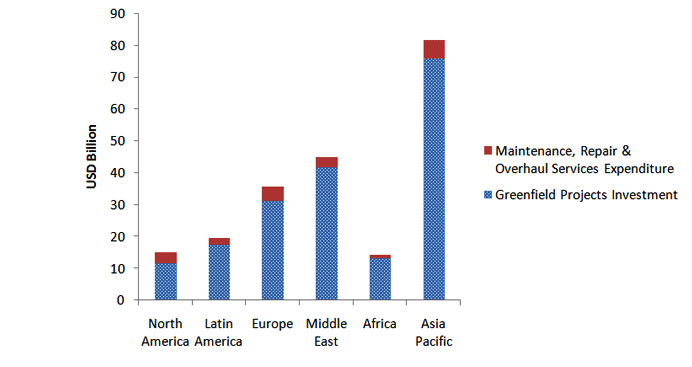

The total refinery investment for Greenfield refinery projects during the period 2017 to 2023 is estimated to be $190.6 billion. Projects in the Asia Pacific region will account for 40 percent of this investment followed by Middle East at 22 percent. Investments in Europe will be mainly driven by projects in Russia and the Caspian Sea region.

Exhibit 4: Total Refinery Investments for Greenfield Projects and Total Expenditure for Refinery MRO Services, by Global Regions, 2017–2023, USD Billion

Even though Asia Pacific region adds significant refining capacity, the region is anticipated to have shortages of middle distillates by 2023. This demand can be met by North America, Middle East and Europe supplies. These regions would have a surplus of middle distillates to cater to the increase Asia demand. North America projects would be geared towards processing of extra light crude from shale oil.

Quantifying the Opportunities

The total refinery investment for Greenfield refinery projects during the period 2017 to 2023 is estimated to be $190.6 billion. Projects in the Asia Pacific region will account for 40 percent of this investment followed by Middle East at 22 percent. Investments in Europe will be mainly driven by projects in Russia and the Caspian Sea region.

Exhibit 4: Total Refinery Investments for Greenfield Projects and Total Expenditure for Refinery MRO Services, by Global Regions, 2017–2023, USD Billion

The refinery MRO services market for the period 2017-2023 is forecast to be $20.4 billion. MRO services opportunities in the Asia Pacific region are expected to grow steadily. The main drivers are increasing maintenance costs that lead to outsourcing of these services to proven contracts. With increasing private sector participation in the Asia Pacific refining sector, this trend is expected to continue.

The refinery sector presents a window of opportunity in the next six years for refinery equipment and MRO service providers, with Asia Pacific region offering the most growth.

See More: Top Marine Tech Solution Companies

The refinery MRO services market for the period 2017-2023 is forecast to be $20.4 billion. MRO services opportunities in the Asia Pacific region are expected to grow steadily. The main drivers are increasing maintenance costs that lead to outsourcing of these services to proven contracts. With increasing private sector participation in the Asia Pacific refining sector, this trend is expected to continue.

The refinery sector presents a window of opportunity in the next six years for refinery equipment and MRO service providers, with Asia Pacific region offering the most growth.

See More: Top Marine Tech Solution CompaniesWeekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also